Community

osapeers.org

Fulfil the requirements of the CO2 Carbon Border Adjustment Mechanism (CBAM) digitally, automatically and with legal certainty and determine the emissions and associated CBAM certificates required for your imported products as part of European emissions trading.

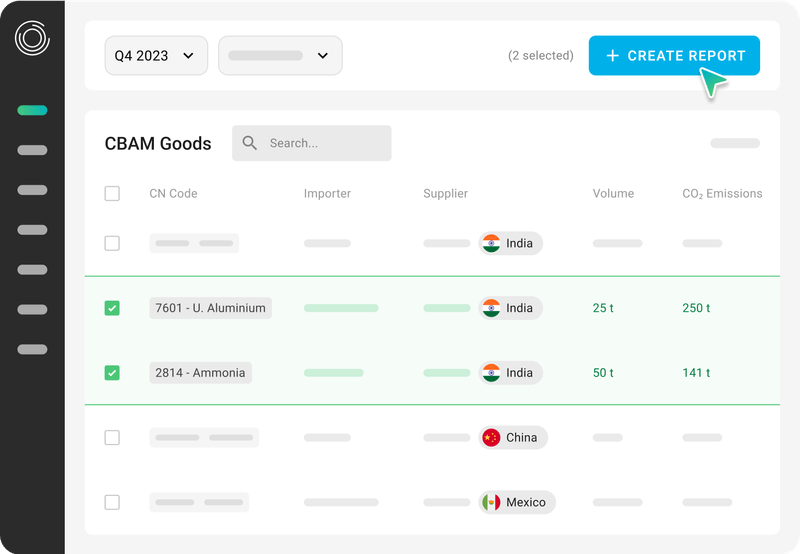

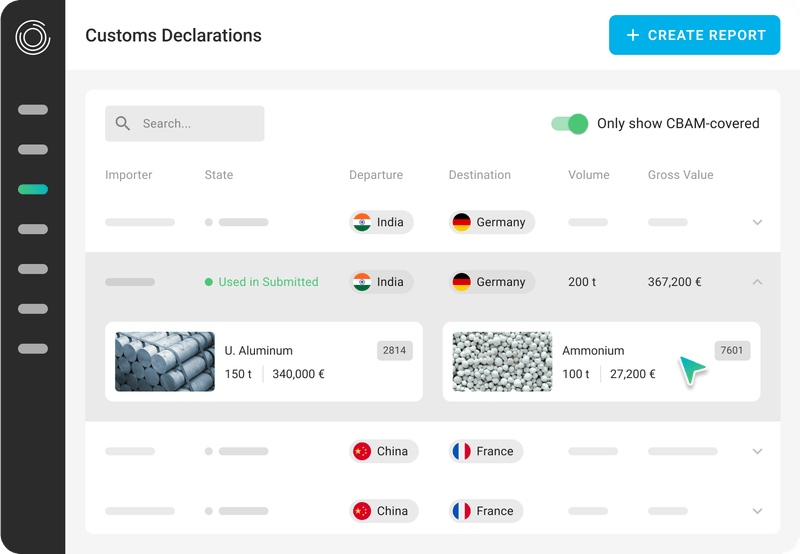

As a first step, our solution automatically checks all your import declarations after a central upload and assigns the goods to specific product groups. At the same time, the import declarations are automatically assigned to reporting periods and customs clearance dates to ensure that the legally required quarterly CBAM report is generated correctly. To this end, the EU will provide default values for categorising the CBAM goods specified in the import declarations by the end of June 2024, as exact emission values are not yet available from suppliers in the transition phase.

Our solution provides an automated initial contact function with suppliers and operators, the so-called ‘Readiness Check’, which determines whether they are currently able to provide accurate emissions data from the manufacturing process of CBAM goods, or will be able to do so by Q3 2024 at the latest. This will sensitise your suppliers to the challenges of CBAM and facilitate subsequent reporting processes.

After a thorough check of the accuracy and reliability of the data provided by type of goods (CN code), the required CBAM certificates are calculated on the basis of the CBAM-relevant import declarations. Both direct and indirect emissions are taken into account to provide a complete picture of the environmental impact of imported goods.

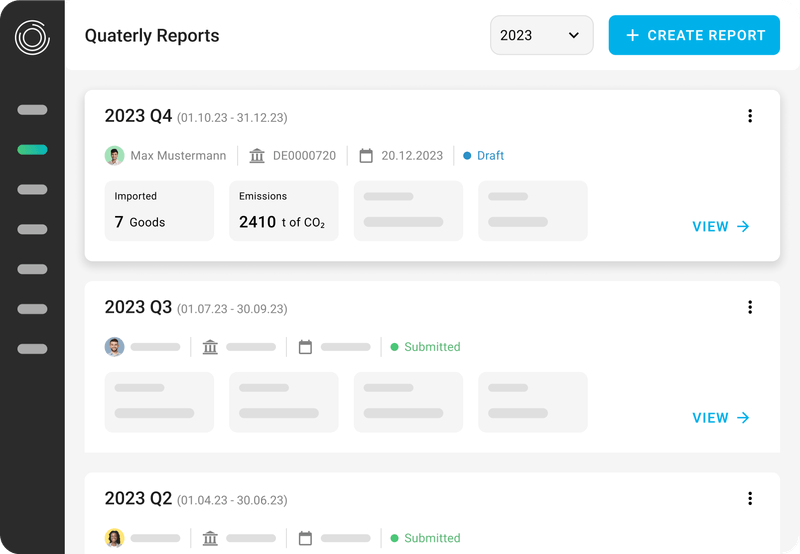

Our solution automates the generation of a CBAM report based on the data collected, providing a detailed breakdown of the total quantity of each type of good produced and the associated CO2 emissions. CO2 prices already paid in the countries of production are also taken into account.

The solution’s built-in alert function, which also enables communication with internal interfaces, automatically reminds you of all quarterly report deadlines. The CBAM report can be created in XML format, allowing you to quickly export all the necessary supporting documents for submission to the EU.

Automate reporting processes to minimise manual effort and produce CBAM reports quickly and compliantly.

Our solution simplifies the complex reporting process, guiding you through each step of the process and proactively alerting you to deadlines at the right time.

Our solution has been developed with legal advice from Graf von Westphalen, a law firm specialising in ESG legislation, and is strictly based on the legal requirements of CBAM.

Whether you have 10 or 10,000 suppliers, our solution meets the needs and is adaptable to companies of all sizes.

Leverage information from different osapiens HUB solutions and use it to comply with other ESG regulations.

Transparent logistics, automated legal obligations and an all-in-one solution for all affected parties to reduce complexity.