Community

osapeers.org

This article is available in

About this article

Yuexuan Niu

AuthorAssigned categories

For many small and medium-sized enterprises (SMEs), sustainability reporting pressure does not come from regulators, but from everyday business reality. Customers, banks, and partners increasingly request ESG information. These requests often come in different formats, cover similar content, and come with tight deadlines. What starts as individual requests quickly turns into recurring manual work. Expectations become unclear and the risk of inconsistent or incomplete answers increases.

The Voluntary Sustainability Reporting Standard for non-listed SMEs (VSME) is designed to address exactly this situation. VSME does not refer to a stock, index, or financial product. It is a voluntary sustainability reporting standard, helping SMEs to structure sustainability information. It also limits unnecessary data requests in the value chain and enables consistent, reusable data for multiple stakeholders. One standardized VSME report can be reused across customers, banks, and business partners. This reduces duplicate requests and ensures consistent disclosures.

VSME does not refer to a stock, index, or financial product. It stands for a sustainability reporting standard for non-listed small and medium-sized enterprises.

The VSME is a voluntary EU framework that helps SMEs report sustainability information in a structured, comparable, and resource-efficient way. It is designed for companies without dedicated sustainability teams and reflects the realities of limited time, data availability, and internal resources.

VSME follows a modular approach, allowing SMEs to scale reporting based on their maturity and stakeholder expectations.

VSME defines a clear scope, structure, and set of indicators for sustainability reporting. Instead of responding differently to each request, SMEs can rely on one consistent data set that can be reused across customers and partners. This reduces duplication. It shortens response times and increases the credibility of disclosed information. Clear definitions and standardized indicators also reduce follow-up questions and ad-hoc clarifications, significantly lowering ongoing coordination effort.

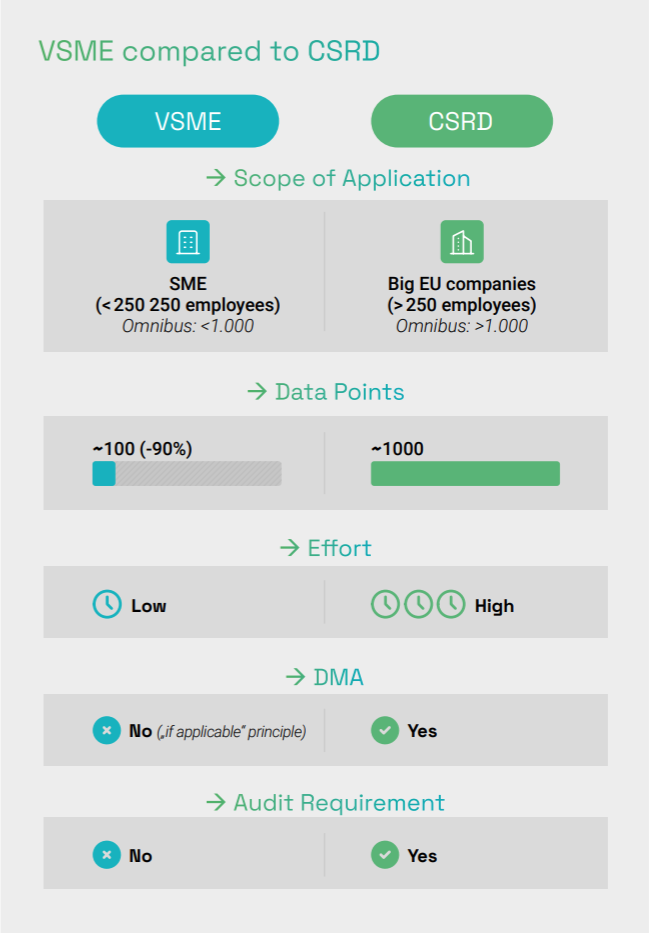

Compared to CSRD, VSME focuses on a clearly limited set of essential disclosures and reduces the number of required data points by up to 90 percent. Sustainability reporting still requires effort. However, the scope remains manageable for SMEs without dedicated teams. VSME is explicitly designed as a starting point, allowing SMEs to begin with a limited scope and expand reporting step by step as requirements or business needs evolve.

Although lighter in scope, VSME is structurally aligned with CSRD and ESRS. In practice, it functions as a translation layer between SMEs and CSRD-reporting companies. This enables SMEs to provide decision-ready, comparable sustainability data without being subject to CSRD themselves. This allows CSRD-reporting customers and financial institutions to use SME data directly. No rework or additional interpretation is required. SMEs stay outside mandatory CSRD obligations while building a reporting foundation that is fully compatible with future regulatory demands.

For SMEs, sustainability reporting increasingly determines access to financing, customers, and regulated value chains. Structured reporting reduces uncertainty, avoids last-minute data requests, and positions companies as reliable partners.

Banks and financial institutions increasingly integrate sustainability criteria into credit assessments. Clear, standardized disclosures enhance transparency, streamline financing processes, and strengthen credibility with lenders. In practice, greater sustainability transparency can lead to faster credit decisions. Depending on the risk profile, it can also result in financing advantages of up to 10 percent. This significantly improves SMEs’ access to capital.

Large companies depend on reliable sustainability data from suppliers to meet their own reporting obligations. SMEs that can provide structured, consistent information gain an advantage in tenders and supplier evaluations and strengthen long-term business relationships.

Collecting sustainability data also creates internal visibility into risks and improvement areas. Over time, this enables SMEs to move from reactive data provision toward more informed operational and strategic decisions, without turning sustainability into a separate function.

This shift is already underway. A 2025 osapiens study shows that 81 percent of sustainability leaders across Europe view sustainability initiatives as a driver of innovation and competitive advantage. As structured sustainability data becomes more widely available, its role in operational and strategic decision-making continues to grow.

Sustainability expectations will continue to increase. SMEs that delay structured reporting face higher effort, rushed processes, and growing uncertainty. Those that establish a clear reporting baseline early reduce future workload, avoid rework, and stay in control as requirements evolve.

Efficient sustainability reporting is difficult to manage without digital support, especially for SMEs without dedicated sustainability teams. The osapiens Sustainability Reporting Suite is designed specifically for small and medium-sized enterprises and supports a direct and pragmatic start with VSME reporting. It provides predefined structures, guided data collection, and built-in alignment with VSME modules. This allows companies to establish a reliable reporting baseline quickly, without complex setup or prior reporting experience.

Sustainability data is centrally managed, reused across modules and stakeholders, and transformed into consistent, audit-ready reports. As ESG requirements evolve, reporting scopes and data points can be expanded step by step. There is no need to rebuild processes from scratch. This reduces manual effort, increases reliability, and helps SMEs respond confidently to requests today while staying prepared for future requirements.