Tempo di lettura 9 min.

Contents

- Understanding the EUDR: Background and Objectives

- Commodities Under the EUDR’s Microscope

- What About Cotton and Man-Made-Cellulosic-Fibers?

- Challenges Ahead: Compliance and Costs

- Opportunities: Innovating for a Sustainable Future

- Navigating EUDR Compliance: How osapiens Can Help

- Conclusion: Paving the Way for a Sustainable Future in Fashion and Textile

The EU Deforestation Regulation (EUDR) is set to transform global trade practices, particularly within the fashion and textile industry, which has long been linked to deforestation. As a game-changer for ethical and sustainable supply chains, the EUDR directly challenges the industry to rethink its supply chains and embrace sustainability. This article examines the far-reaching implications of EUDR’s impact on the fashion and textile industry, exploring the challenges it poses, the opportunities it presents, and the potential future developments that could further expand its scope.

Understanding the EUDR: Background and Objectives

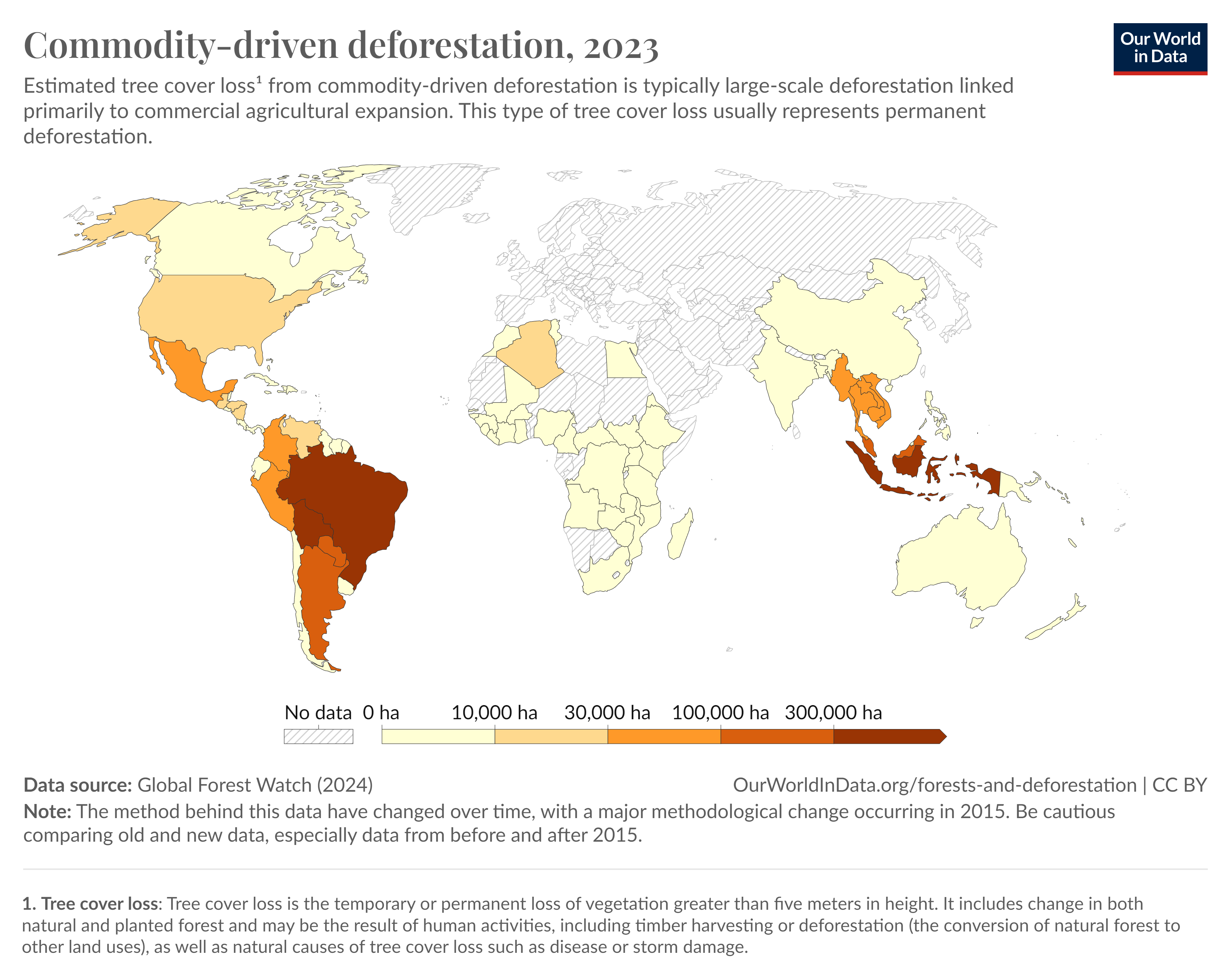

The EUDR is a key component of the European Union’s broader strategy to combat climate change and biodiversity loss. At its core, the regulation aims to prevent the import of products associated with deforestation or forest degradation into the EU market. This includes key commodities like soy, palm oil, cattle, rubber, cocoa, coffee, and timber, all of which must now be sourced in a way that is proven to be deforestation-free. The European Parliament estimates that the EU accounts for around 10% of global deforestation through its consumption of imported goods.

Scope and Potential Expansion of the EUDR

The regulation covers several critical commodities integral to the fashion industry, including leather (cattle) and rubber. However, it does not currently extend to materials like cotton and Man-Made Cellulosic Fibers (MMCF), despite their significant environmental impact. The European Commission is planning on revising and extending the regulation’s scope through a delegated act, based on assessments of additional commodities’ impacts on deforestation. The first review of the EUDR’s commodity scope is scheduled to occur within two years of its entry into force.

Furthermore, the EUDR relies on the United Nations Food and Agriculture Organization’s (FAO) definition of forest, which includes 4.06 billion hectares of forests globally. This definition also encompasses savannahs, wetlands, and other valuable ecosystems as defined by national laws. The regulation’s first review, within one year of its enforcement, will assess the impact of expanding its scope to include ‘other wooded land.’ A second review, scheduled for two years post-enforcement, will consider expanding the regulation to cover ecosystems beyond forests.

Commodities Under the EUDR’s Microscope

Leather: A Major Target of EUDR

The global leather goods market, valued at over $250 billion in 2023, is a significant focus of the EUDR. The EU is a major importer of leather products, much of which is sourced from Brazil, where cattle ranching accounts for up to 80% of deforestation in the Amazon rainforest (WWF). With the EUDR, fashion brands are required to trace the origin of their leather and ensure it is deforestation-free, fundamentally challenging existing supply chain practices.

Furthermore, the European leather market is deeply intertwined with high-end fashion and luxury goods, sectors that heavily rely on genuine leather. The region’s strong tradition of craftsmanship and the prominence of luxury brands make Europe a critical player in the global leather market. However, the EUDR’s stringent regulations on deforestation-free sourcing are set to significantly impact this sector. Brands operating in Europe must now ensure that their leather is not only of the highest quality but also compliant with the new sustainability standards. This is particularly important as consumer demand in Europe increasingly shifts towards products that are ethically sourced and environmentally friendly, making compliance with the EUDR both a regulatory necessity and a competitive advantage.

Rubber: Under EUDR Scrutiny

Similarly, the global rubber market is under scrutiny. Natural rubber, which is extensively used in the production of footwear and accessories, as well as in technical coated textiles, has often been linked to deforestation in tropical regions. The EUDR requires fashion companies to verify that their rubber sourcing does not contribute to deforestation, potentially driving significant changes in material sourcing and production practices.

What About Cotton and Man-Made-Cellulosic-Fibers?

Despite their significant environmental impact, cotton and MMCF, such as viscose and rayon, are not currently included under the EUDR’s regulations. According to the FAO, the global cotton industry is valued at over $50 billion annually, producing more than 25 million tonnes each year. Cotton farming is a significant driver of deforestation in Brazil, particularly in the Cerrado region, which is one of the country’s major agricultural areas. The expansion of cotton cultivation has contributed to severe deforestation and ecosystem degradation.

MMCF: The Hidden Impact on Forests

Most people are aware of the link between forests and paper, but few realize that the forests are also deeply connected to the clothes in their closets. Man-Made Cellulosic Fibers (MMCF) such as viscose, rayon, modal, and lyocell, although derived from renewable resources like wood, have a significant environmental footprint due to their production processes. All these fibers originate from plants, particularly trees, making them highly dependent on forest resources, contributing to large-scale deforestation.

All these fibers share a common problem: the sourcing of raw materials. The production of MMCFs heavily relies on wood from forests, including endangered and ancient forests. More than 300 million trees are logged every year and turned into cellulosic fabrics, contributing to deforestation and threatening biodiversity. Forests are being cleared to create fabrics for next season’s fashion collection.

The connection between forests and fashion is not widely recognized, but it is critical. MMCFs are integral to the production of both fast fashion and luxury garments. Unfortunately, as demand grows, so does the pressure on forests, leading to the destruction of vital ecosystems that play a key role in carbon sequestration and the preservation of biodiversity. The loss of these forests accelerates climate change and depletes habitats for endangered species. At the current rate of extraction, scientists warn that 55% of the Amazon rainforest could be lost or severely damaged by 2030.

Challenges Ahead: Compliance and Costs

The EUDR presents formidable challenges for the fashion industry, particularly in terms of compliance and the associated costs.

Supply Chain Transparency and Traceability

For fashion brands, particularly those with complex, multi-tiered supply chains, the EUDR presents formidable challenges. The global fashion industry depends on a vast network of suppliers. Implementing the traceability required to comply with the EUDR could significantly increase operational costs. This will necessitate significant investments in supply chain management technologies, which could strain the resources of companies already operating on thin margins.

Increased Costs

The push for sustainable sourcing under the EUDR is likely to lead to higher production costs. Sustainable leather is often more expensive than conventional leather due to the ethical sourcing, environmental considerations, and certification processes involved, which can drive up production costs. Additionally, companies will need to invest in technologies for traceability and certification, further driving up costs. These expenses may ultimately be passed on to consumers, potentially impacting product affordability.

A report from Grand View Research highlights the growing global demand for leather goods, driven by high-end fashion and luxury brands. Europe remains a key region for luxury leather products, with brands focusing on premium materials and craftsmanship. However, the market’s growth may be impacted by increasing sustainability demands, as consumers and regulators push for more ethical sourcing of leather. As sustainability becomes a greater focus, companies in the European market will need to balance the cost of sustainable leather sourcing with consumer expectations for quality and environmental responsibility.

Legal and Reputational Risks

Non-compliance with the EUDR carries significant legal and reputational risks. Fines can reach up to 4% of a company’s annual global turnover in the EU. Moreover, brands that fail to comply may suffer severe reputational damage, especially as sustainable products become the norm for EU consumers as a series of new ESG laws enter into force.

Opportunities: Innovating for a Sustainable Future

Despite the challenges, the EUDR offers significant opportunities for brands that have already invested in sustainable practices.

Competitive Advantage Through Sustainability

The global sustainable fashion market is expected to grow steadily, with increasing consumer demand for environmentally responsible products. Brands that can demonstrate compliance with the EUDR are likely to gain a competitive edge, appealing to the growing market of environmentally conscious consumers.

Innovation in Materials and Practices

The need for compliance is also likely to drive innovation in the fashion industry. Brands may explore alternative materials or develop new technologies to enhance supply chain transparency and sustainability. For instance, the development of lab-grown or alternative materials could gain traction as companies seek ways to meet the stringent requirements of the EUDR.

Expanding Market and Building Trust

Complying with the EUDR could enhance a brand’s reputation, leading to increased consumer trust and potentially opening up new markets. As consumers become more discerning about the environmental impact of their purchases, brands that can demonstrate strict adherence to sustainability standards are likely to benefit from increased market share.

Navigating EUDR Compliance: How osapiens Can Help

As the fashion industry grapples with the challenges posed by the EUDR, companies must find effective ways to ensure compliance while maintaining operational efficiency. This is where osapiens comes in. osapiens offers a comprehensive software solution designed specifically to help businesses meet EUDR requirements. By leveraging osapiens’ EUDR compliance solution, the osapiens HUB for EUDR, fashion brands can streamline their supply chain management, ensure traceability, and stay ahead of regulatory changes.

The osapiens HUB is a comprehensive ESG platform designed to provide solutions for compliance with a wide range of ESG regulations, not just the EUDR. Its benefits go beyond regulatory adherence by optimizing and automating supply chain processes, ensuring greater transparency and efficiency. The platform enables businesses to gain full visibility into their supply chains, making them more traceable, efficient, and sustainable. With the osapiens HUB, companies can seamlessly integrate sustainability into their operations while meeting compliance requirements, driving long-term impact, and ensuring a competitive edge in an increasingly sustainability-focused market.

Conclusion: Paving the Way for a Sustainable Future in Fashion and Textile

The EUDR is set to significantly reshape the fashion and textile industry by imposing stringent requirements on supply chain transparency and sustainability. While the regulation presents challenges, such as increased costs and the need for more advanced supply chain management, it also opens opportunities for innovation and leadership in sustainable fashion.

As the regulation evolves, with potential expansions to include materials like cotton and MMCF, the fashion industry must adapt to new regulatory standards and continue pushing for sustainability. By leveraging solutions like osapiens, brands can not only ensure compliance but also position themselves at the forefront of the movement toward ethical and sustainable practices, establishing themselves as leaders in the global push for more responsible fashion.

About osapiens

osapiens develops innovative software-as-a-service solutions that enable companies to implement ESG requirements in a fast, automated and secure way. At the core is the osapiens HUB, an AI-powered cloud platform that creates compliance and transparency across the entire value chain.

With osapiens, companies master all ESG challenges: They identify risks, implement reporting obligations such as CSRD, EUDR and LkSG, and make their operations more sustainable.

osapiens was founded in Mannheim, Germany in 2018 and was awarded the German Founder Award in the “Rising Star” category in 2022. Today, osapiens is a leading provider of ESG software solutions and works with an international team of more than 300 employees for more than 1,700 customers worldwide.

Christian Feuring

External Communications Manager

Indietro

Indietro